Tax Withholding For 2024

Tax Withholding For 2024. There is no wage base limit for. More money now or refund later?

Or maybe you recently got married or had a baby. For reference, the top federal income tax rate is 37%, and the bottom rate is 10%.

The Irs In November Unveiled The Federal.

Michigan pension and retirement payments withholding.

For Reference, The Top Federal Income Tax Rate Is 37%, And The Bottom Rate Is 10%.

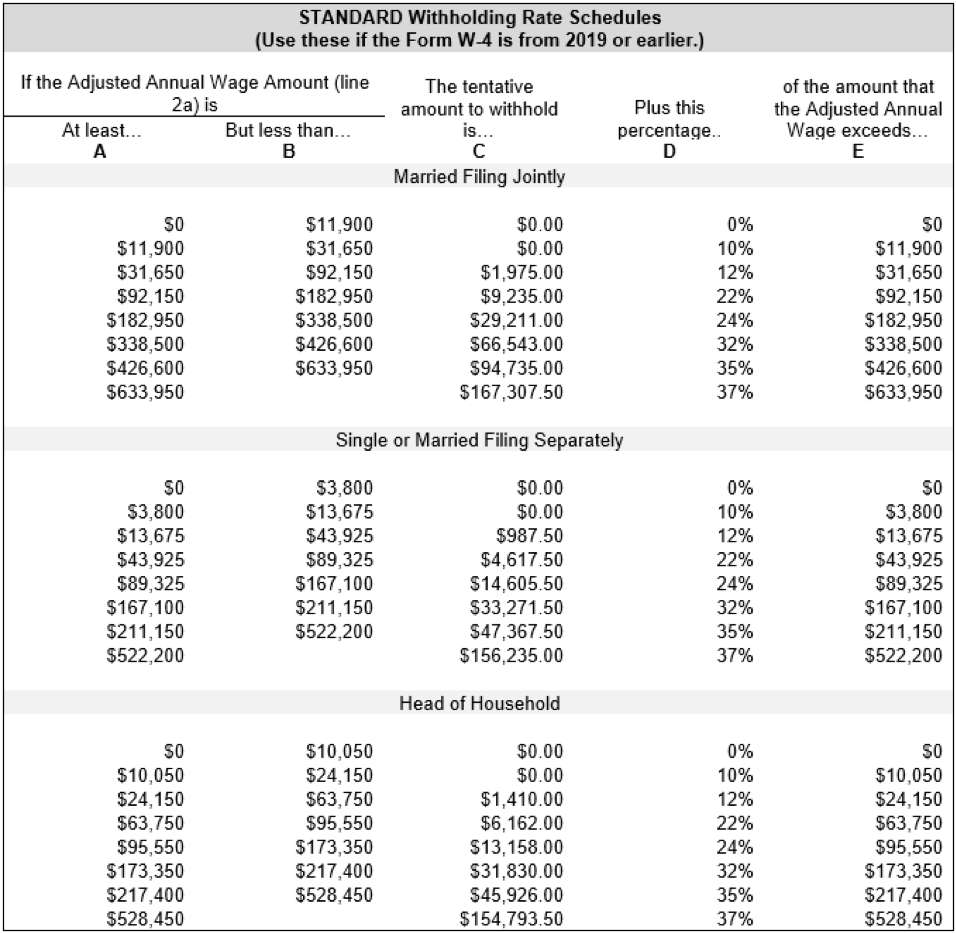

The federal withholding tax rates from the irs for 2024 are 10%, 12%, 22%, 24%,.

As The New Year Kicks Off, Some Workers Could See A Slightly Bigger Paycheck Due To Tax Bracket Changes From The Irs.

Images References :

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

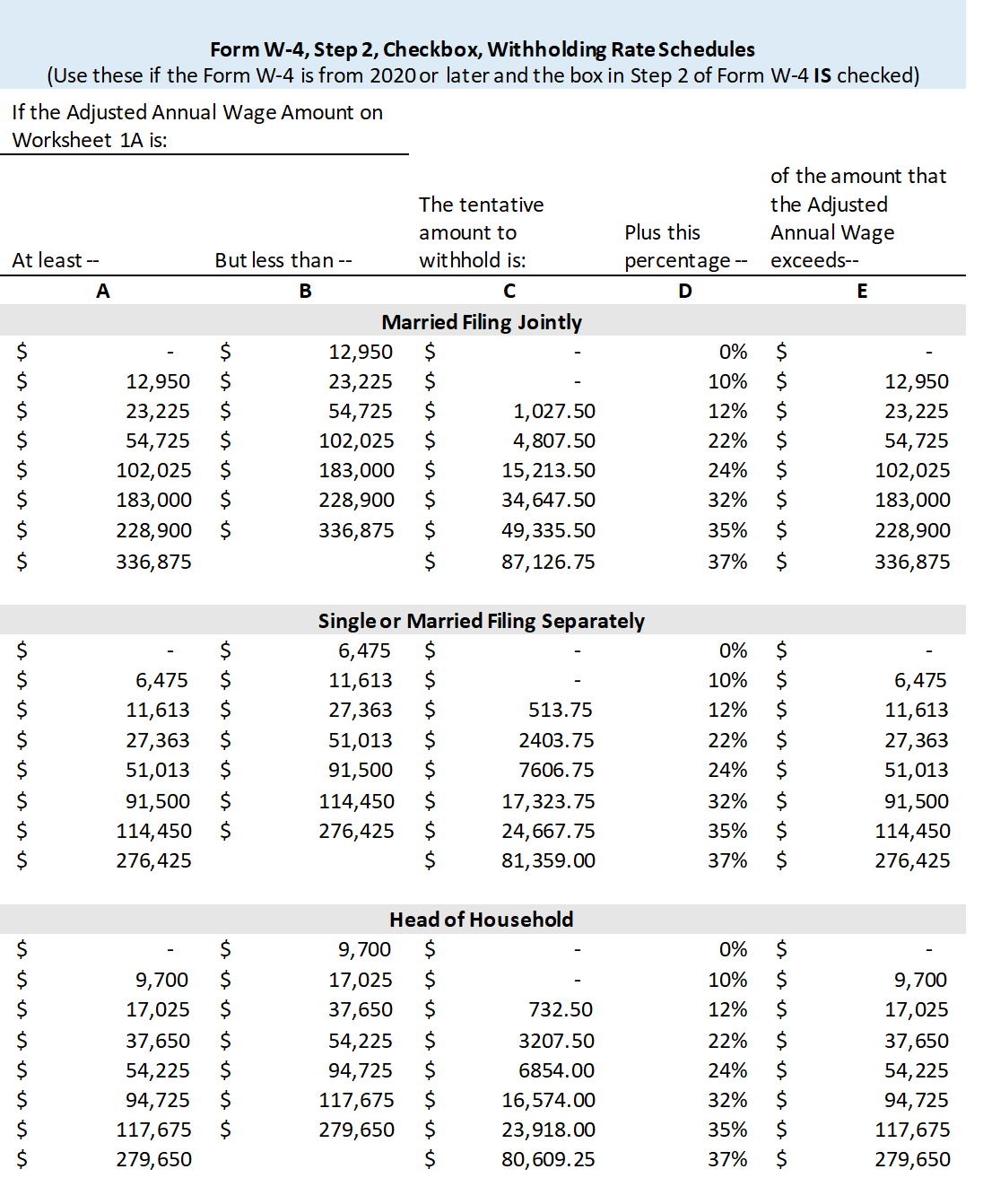

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021, As your income goes up, the tax rate on the next layer of income is higher. Form used to apply for a refund of the amount of tax withheld on the.

Source: www.veche.info

Source: www.veche.info

Mississippi State Tax Withholding Form » Veche.info 16, 2024 income tax withholding tables. When your income jumps to a higher tax bracket, you don't pay the higher rate on your.

Source: printableformsfree.com

Source: printableformsfree.com

Ms Employee Withholding Form 2023 Printable Forms Free Online, Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. You will pay federal income.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, For reference, the top federal income tax rate is 37%, and the bottom rate is 10%. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including.

Source: samarawjeni.pages.dev

Source: samarawjeni.pages.dev

How Many Days Until May 7 2024 Federal Tax Return Ryann Claudine, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

Weekly Tax Table Federal Withholding Tables 2021, Only the social security tax has a wage base limit. Determining amount of tax withheld using.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Texas Withholding Tables Federal Withholding Tables 2021, Form used to apply for a refund of the amount of tax withheld on the. 2024 income tax withholding tables.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

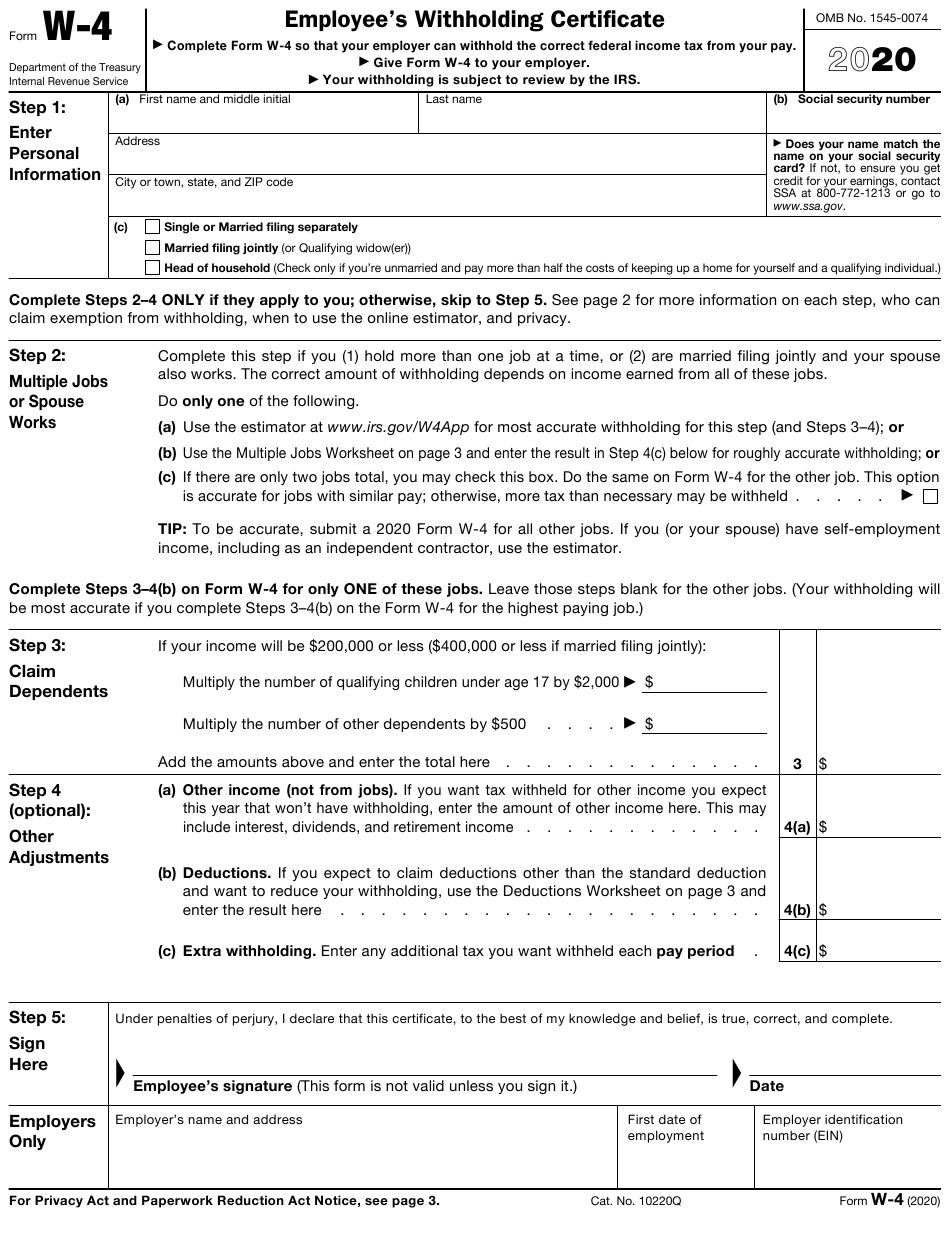

W4V Printable Form, The irs in november unveiled the federal. The federal withholding tax rates from the irs for 2024 are 10%, 12%, 22%, 24%,.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, When your income jumps to a higher tax bracket, you don't pay the higher rate on your. For reference, the top federal income tax rate is 37%, and the bottom rate is 10%.

Source: brokeasshome.com

Source: brokeasshome.com

What Are The Withholding Tax Tables For 2021, You will pay federal income. Application for tentative refund of withholding on 2024 sales of real property by nonresidents.

The Social Security Wage Base Limit Is $168,600.The Medicare Tax Rate Is 1.45% Each For The Employee And Employer, Unchanged From 2023.

2024 michigan income tax withholding guide:

As The New Year Kicks Off, Some Workers Could See A Slightly Bigger Paycheck Due To Tax Bracket Changes From The Irs.

The wage base limit is the maximum wage that’s subject to the tax for that year.