Single Standard Deduction 2024 Over 65

Single Standard Deduction 2024 Over 65. If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year. Seniors over age 65 may claim an additional standard deduction of.

You don’t pay federal income tax on every dollar of your income. Single or head of household:

Seniors Over Age 65 May Claim An Additional Standard Deduction Of.

The usual 2024 standard deduction of $14,600 available to single filers, plus one additional.

Your Standard Deduction Consists Of The.

You deduct an amount from your income before you calculate taxes.

If You Don't Itemize Deductions, You Are Entitled To A Higher Standard Deduction If You Are Age 65 Or Older At The End Of The Year.

Images References :

Source: www.vrogue.co

Source: www.vrogue.co

Standard Deduction For 2021 22 Standard Deduction 2021 www.vrogue.co, That means a single taxpayer 65 or older (or who is blind) can claim a total standard deduction of $16,550 on their 2024 federal tax return. For 2024, assuming no changes, ellen’s standard deduction would be $16,550:

Source: lennaqevelina.pages.dev

Source: lennaqevelina.pages.dev

Federal Standard Deduction 2024 Audrye Jacqueline, $27,700 (up from $25,900 in 2022) single taxpayers and married. For 2024, assuming no changes, ellen’s standard deduction would be $16,550:

Standard deduction amounts for 2021 tax returns Don't Mess With Taxes, If you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married seniors are entitled to an additional $1,550. There’s even more good news for older taxpayers.

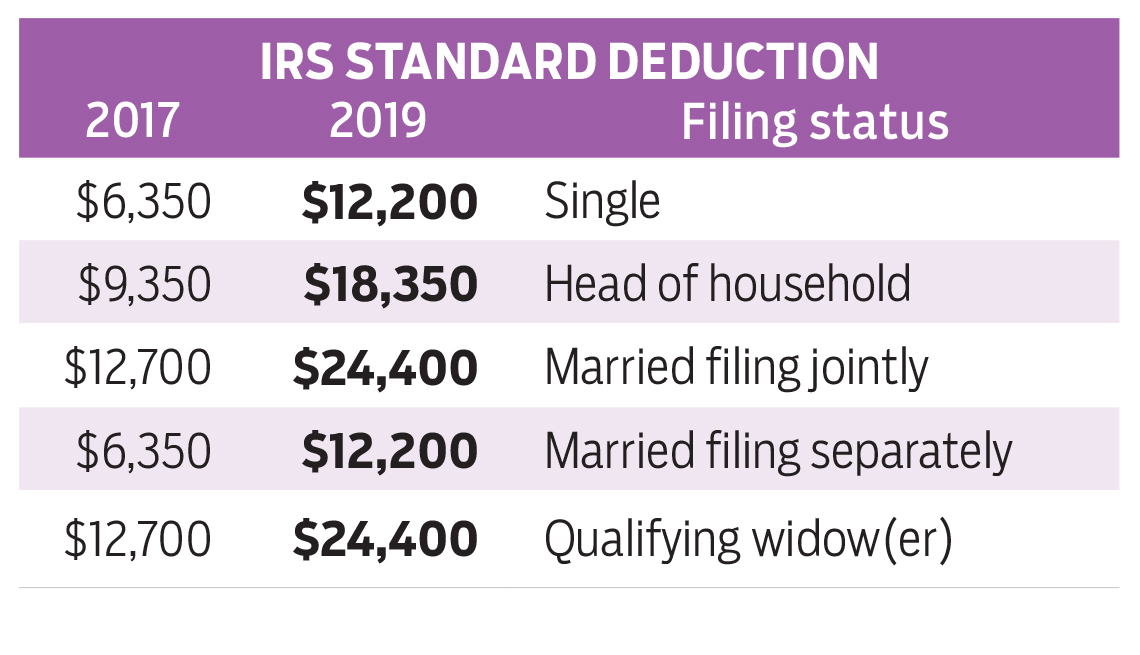

The IRS Just Announced 2023 Tax Changes!, Single or head of household: Your standard deduction consists of the.

Source: www.humaninvesting.com

Source: www.humaninvesting.com

Really? My Bonus is Taxed the Same as my Paycheck? — Human Investing, 2024 standard deduction over 65. $14,600 for married couples filing separately;

Source: www.aarp.org

Source: www.aarp.org

Give to Charity, but Don’t Count on a Tax Deduction, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). Each joint filer 65 and over can increase the standard deduction by $1,550 apiece, for a total of $3,100 if both joint filers are.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

2021 Tax Changes And Tax Brackets, Married filing jointly and married filing. The 2023 standard deduction for tax returns filed in 2024 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household.

Source: brandingnored.weebly.com

Source: brandingnored.weebly.com

Tax tables 2021 brandingnored, Seniors over age 65 may claim an additional standard deduction of. For 2024, assuming no changes, ellen’s standard deduction would be $16,550:

Source: urbanaffairskerala.org

Source: urbanaffairskerala.org

IRS Standard Deduction 2023, Standard Deduction Calculator, You deduct an amount from your income before you calculate taxes. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

Source: www.pearsoncocpa.com

Source: www.pearsoncocpa.com

11 MMajor Tax Changes for 2022 Pearson & Co. CPAs, 2024 additional standard deduction amounts: Here are the standard deduction amounts set by the irs:

65 Or Older Or Blind:

Single or head of household:

The Standard Deduction For Tax Year 2024 Is $14,600 For Single Taxpayers And Married Couples Filing Separately, $21,900 For Head Of Household Filers, And $29,200 For.

Here are the standard deduction amounts set by the irs: